Gold Prices Aiming for $2,500 Amid Economic and Geopolitical Uncertainty

Gold prices rise due to a buying trend supported by economic factors and global events. The gold spot price closed at $2,446 on Thursday and was up by more than $50 on Tuesday. Saqib Iqbal, a financial markets analyst, at Trading.Biz, analyses multiple factors to forecast the gold prices in the coming weeks.

- Gold price looks to test the $2,500 level and post fresh all-time highs amid geopolitical events.

- Fed’s potential rate cut policy lends further support to the metal.

- Economic uncertainty keeps investors shy from risk assets, increasing further demand for gold.

A recent survey by the Institute of Supply Management showed that the US Manufacturing Purchasing Managers Index (PMI) dropped to 46. 8 in July, the lowest level since November 2015 from the previous level of 48. 5 and below the market expectation of 48. 8. Furthermore, Claimants filed the US Initial Jobless Claims for the week ending 26 July at 249K, up from 235K last week and above the forecasts of 236K.

The Federal Reserve has taken another policy decision recently affecting gold prices. Recently, in its July meeting, the Fed left the interest rate unchanged in the band of 5.25 – 5.50 percent.

Federal Reserve Chairman Jerome Powell suggested the possible move towards easing the monetary policy, suggesting that he is ready to bring down interest rates if the inflation pressure remains subdued. Typically, lower interest rates increase the demand for non-interest earning assets like gold because of the cost of holding these assets.

Saqib Iqbal states, Gold is considered a safe-haven investment because of the rising unrest in the Middle East region. This includes the reason that the recent targeted elimination of Hamas’s Ismail Haniyeh in Iran has furthered regional volatility.

This, in turn, has brought tensions between Iran and Israel, whereas both sides and even Hamas laid blame on Israeli individuals behind the strike.”

However, other global conflicts also sustain gold prices as they continue in the Middle East. The prolonged confrontation between Russia and Ukraine and China’s militarization linked to Taiwan make investors shy away from risk assets, turning to gold.

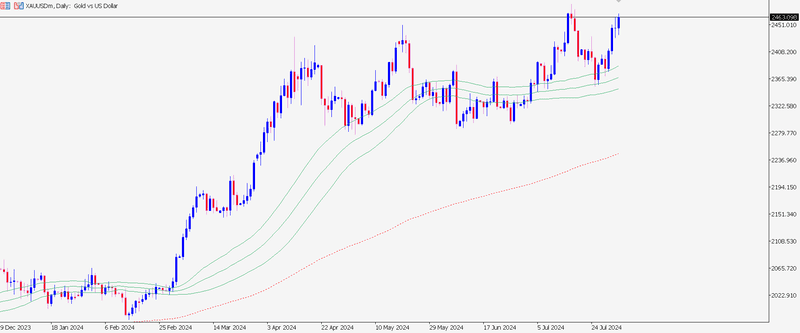

He further commented, “The technical picture also supports the precious metal. The double top at the previous all-time high indicates a potential breakout leading to the $2,500 mark. The only hurdle for gold’s bullish trend is profit-taking while the primary trend remains strongly positive in the long run.”

Login with Google

Login with Google