EXANTE BROKER REVIEW 2024: FEES AND BENEFITS

This Trading Platform is available in Ukraine

EXANTE has garnered mixed reactions from users, with some praising the platform for its wide range of financial instruments and user-friendly interface. Clients appreciate having access to global markets and the ability to trade various assets through one account. The customer service is often highlighted as responsive and helpful, addressing queries efficiently.

However, other users have experienced issues, particularly regarding withdrawal processes which can be slow or cumbersome. Some reviews also point out higher fees compared to competitors, which could be a drawback for cost-conscious traders. There are mentions of technical glitches that occasionally hinder trading activities, causing frustration among clients.

Overall, while EXANTE offers extensive trading opportunities and supportive customer service, potential users should weigh these benefits against the concerns over fees, withdrawal delays, and occasional technical problems before deciding if it's the right broker for their needs.

* The amount that will be credited to the account in the case of a successful deal

* General Risk Warning: Your capital might be at risk

I hadn’t heard of Exante until just a few months ago, so I decided to check them out and compare them against other global brokers such as Interactive Brokers. I was surprised to find that they are comparable and available in most countries around the world.

If you are looking for a broker that provides access to international stock markets, as well as forex, crypto, futures, bonds, mutual/hedge funds, and options all from one platform – at very low commissions – then Exante is a broker to consider. Here are its pros and cons, along with what you need to know before trading with this broker.

Summary Pros and Cons of Exante

| Pros | Cons |

| Go global: Access global markets in a secure trading environment from one account. Trade stocks, forex, futures, cryptocurrencies, options, mutual/hedge funds, and bonds all from one account. | Inactivity fee: €50 inactivity fee applied after six months, but only if you have no open position and the account balance is below €5000. |

| Plenty of choices: Trade over 600,000 financial products from various asset classes and markets/countries around the world | WIthdrawal fee: There is a €30 (or equivalent in other currencies) withdrawal fee for any withdrawal from the account. Withdrawals take 3-5 days to receive funds. |

| Futuristic interface: The Exante trading platform has a user-friendly interface that gives a futuristic look, yet is user-friendly to use. | Limited Deposit/Withdrawal Methods: Can only use bank transfers |

| Discount commission: Exante is a low fee broker, which keeps costs low for traders. | High Minimum Deposit: €10,000 minimum required. |

| Direct Market Access: Exante’s platform allows you to interact with markets directly, with no broker intervention. | |

| Regulated with Client Fund Safety: Exanted is regulated in multiple jurisdictions and keeps client’s funds in trust in a separate account from its own. |

Is Exanted Regulated and Safe to Trade With?

Depositing with a broker is the biggest trade we make – we are trusting that broker with our funds. Thankfully, Exante is a trustworthy broker. Here’s why.

Exante is regulated in the UK, Euro zone, and Hong Kong.

Being regulated means the broker is subject to regulatory oversight and must adhere to local laws. Exante also keeps clients’ funds in a segregated account, away from their own business accounts. If Exante were to get into financial trouble, client’s funds are safe in a separate account.

Exante.eu has a 3.1 rating out of 5 on Trustpilot, with most of the complaints arising from the withdrawal fee. They have been in business for more a decade and have more than 600 employees.

Exante Trading Fees

Exante provides access to over 600,000 financial assets from various asset classes from countries around the world. Here’s a summary of the fees.

You can see all of Exante’s trading fees via the Markets page. Click on asset class to see the current fees. The table below provides a summary outline.

| US Stocks and ETFs | 0.02/share (minimum $1 commission) |

| International Stocks and ETFs | 0.05% of amount and up ($1 equivalent minimum) |

| Forex | Tight spreads + 0.005% of the amount |

| Metals | $3 or 0.005% per trade |

| Futures | $1.5 per contract and up, or 0.03% and up |

| Options | $1.5 per contract and up |

| Bonds | 9 basis points |

| Crypto | 0.25% |

The table provides a quick overview of the commissions Exante charges. As mentioned though, they offer hundreds of thousands of products, and fees vary between them. Before trading, check the Markets page above to see the exact rate for the product you’re trading.

If trading crypto, for comparison, Binance crypto fees start at 0.1% and drop from there based on increased trading volume.

- OctaFX Review 2024: Is it worth it?

- 10TRADEFX REVIEW 2025: IS IT WORTH IT?

- Free Online Interactive Binary Options Charts and Why You Should Use Them

- Have You Heard About Crypto Binary Options?

- 110 Trading Quotes to Set You on the Road to Success

- Is Quotex a scam? Read this before trying the broker in 2024

Exante Product Offers

Exante offers more than 600,000 financial instruments. Here is a summary rundown of what they are.

The list has been broken down into asset classes, with the assets or exchanges available for trade in that asset class outlined in each.

| Forex | |

| EUR/GBP | GBP/USD |

| AUD/USD | USD/CAD |

| EUR/USD | USD/CHF |

| EUR/JPY | USD/JPY |

There are more than 50 currency pairs in total to trade.

| Stocks and ETFs – Markets Available | |

| American Stock Exchange | Archipelago Exchange |

| Athens Stock Exchange | Australian Securities Exchange |

| BATS Global Markets | Borsa Italiana |

| Borsa İstanbul | Copenhagen Stock Exchange |

| Euronext Amsterdam | Euronext Brussels |

| Euronext Ireland | Euronext Lisbon |

| Euronext Paris | Helsinki Stock Exchange |

| Hong Kong Exchanges and Clearing Limited | Johannesburg Stock Exchange |

| London Stock Exchange | London Stock Exchange Alternative Investment Market |

| London Stock Exchange International Order Book | Madrid Stock Exchange |

| Nasdaq Stock Market | New York Stock Exchange |

| Nordic OMX | Oslo Stock Exchange |

| OTC Markets Group | Prague Stock Exchange |

| Singapore Exchange | Stockholm Stock Exchange |

| Swiss Exchange | Tel-Aviv Stock Exchange |

| Tokyo Stock Exchange | Toronto Stock Exchange |

| Vienna Stock Exchange | Warsaw Stock Exchange |

| Xetra Stock Exchange | |

This means you can trade any stocks that are listed on these exchanges, comprising most of the stocks in the world.

| Metals | |

| Copper | Platinum |

| Gold | Silver |

| Palladium | |

Metals are popular assets among traders and investors for both short-term and long-term speculation.

| Futures – Exchanges Available | |

| Australian Securities Exchange | Borsa İstanbul |

| Chicago Board of Trade | Chicago Mercantile Exchange |

| Commodity Exchange, Inc. | Eurex Exchange |

| CBOE Futures Exchange | Hong Kong Exchange |

| New York Mercantile Exchange | Osaka Exchange |

| Singapore Exchange | Tokyo Commodity Exchange |

Many assets, such as stock indices, commodities, and cryptocurrencies trade via futures contracts.

| Options Trading – Exchanges Available | |

| Australian Stock Exchange | Chicago Board of Trade |

| Chicago Board Options Exchange | Chicago Mercantile Exchange |

| Commodity Exchange, Inc. | EUREX (DTB, SOFFEX) |

| Hong Kong Exchange | New York Mercantile Exchange |

| Osaka Securities Exchange | |

Options are trades on stocks, currencies, stock indices, and many others assets. They are a derivative contract, which means their value is based on the moving of the underlying asset the option is based on.

| Bonds | |

| Euronext Bonds | European Corporate |

| European Government | Exotics |

| Malta Stock Exchange | US Corporate |

| US Government | |

Bonds are asset classes generally used by investors trading over the long-term.

Exante Deposit & Withdrawal Methods and Minimums

Exante has limited deposit and withdrawal methods, and also requires a minimum deposit amount.

Exante allows you to deposit or withdraw via bank transfer only. The minimum deposit amount is €10,000. The withdrawal fee is €30 or equivalent in other currencies. Because of this, you will generally need to make large withdrawals.

Making small withdrawals will result in paying excessive fees. Deposits and withdrawals and can made in 14 different currencies: GBP, USD, JPY, EUR, CHF, CZK, SEK, CAD, HKD, MXN, PLN, NOK, SGD, and AUD. Looking for a broker with a smaller minimum deposit? Check out our BDSwiss and Olymp Trade reviews.

Exante Account Types

Exante offers both individual investor accounts, as well as business accounts.

Here are the four account types that Exante Offers:

| Private Investors

Offers private investors direct access to more than 50 global markets and the ability to trade various financial instruments, such as stocks, ETFs, bonds, futures, options, metals, fiat, and cryptocurrencies from a single multi-currency account. |

Family Offices

The service is designed for private financial agencies that manage investments for high net worth families and groups. It offers a choice of jurisdiction, simplified asset transfer, and the highest level of investor protection through a globally licensed and award-winning platform. |

| Wealth Managers

This service caters to wealth and asset managers who manage the investments of multiple clients. It provides access to new exchange-traded and over-the-counter instruments for clients and offers effortless multi-account management and detailed reporting. Additionally, the service offers 24/7 customer care to facilitate high-touch investor relations and personalized wealth management services. |

Banks and Financial Companies

This service is aimed at banks and other large financial institutions seeking to utilize third-party brokerage platforms and services. The benefits include regulatory compliance, rapid setup and onboarding, well-established technology, effortless deployment, and detailed reporting. |

All retail/private clients get the same account and are subject to the same fees.

- Applying Fractal Reversal With RSI Filter in Trading Strategy

- How to set take-profit and stop-loss on the IQ option platform?

- Is Quotex a scam? Read this before trying the broker in 2024

- How Long Does It Take To Get One Bitcoin?

- What does a forex trader do? What is forex trading?

- eOption review 2024: should you sign up with this broker?

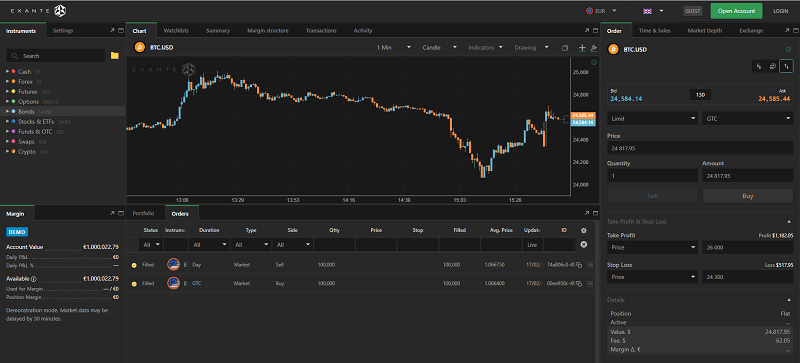

Exante Trading Platform and App

The Exante trading platform is one of the most user-friendly I have found for placing orders. It is fast, streamlined, and provides access to all markets on one platform on any device.

Exante provides their own trading platform, available as a web-based version on the Exante website. It can also be downloaded to desktop (Linux, Windows, or MacOS) or to a Android or Apple device.

All the assets you can trade are in the Instruments box in the top left. Use the search box to quickly find the asset you want to trade. Upon selecting an asset, the chart automatically loads. You can view your account information in the bottom left.

The “Portfolio and Orders” section on the bottom shows your current positions and current orders. On the right is where you can place your orders. You’re able to easily send out various order types with stop losses and profit targets attached.

You can also see Market Depth and Time & Sales for any market. A great feature for seeing what orders are out there from other traders. Overall, the platform is straightforward to navigate, with easy-to-use charts (with indicators and drawing tools).

Brokers like Spreadex have a great trading platform as well; you can check them out.

- Review of Best Binary Option Brokers in 2024

- Top Five Richest and Most Influential Traders Today

- Moon Bitcoins Review 2024 (Legit Or Scam)

- Have You Heard About Crypto Binary Options?

- The Most Popular Trading Assets For Binary Options

- Intrade.Bar Unleashed: Squeezing Potential in Binary Options Trading

Exante Support and Trading Education

Customer service is essential to make users feel comfortable with their broker. Exante provides responsive customer support, as well as an extensive help section and market analysis.

You can contact Exante in multiple ways:

- Phone: +357 2534 2627

- Email: [email protected]

- Web: https://exante.eu/company/contact_us/

Exante’s address is:

28 October Avenue, 365

Vashiotis Seafront Building

Offices 102, 103, 501,

3107, Limassol, Cyprus

You’ll also have access to an extensive help directory, with answers to commonly asked questions about opening accounts, the trading platform, and the markets offered for trading.

If you are looking for trading education or analysis, Exante also offers that. They provide regular market insights and analysis on the Insights page.

Discover top binary options brokers tailored to your region. Browse our curated lists by country:

All Brokers | Top Brokers | USA | Canada | UK | Australia | Nigeria | India | New Zealand | Germany | Turkey | Spain | France | Ukraine | China | Indonesia | Pakistan | Bangladesh | Russia | Mexico | Japan | Brazil | Philippines | Vietnam | Iran | South Africa | Italy | South Korea | Argentina

Login with Google

Login with Google