Applying Fractal Reversal With RSI Filter in Trading Strategy

Bill Williams is one of the most famous traders in the world. He was, in fact, a pioneer in the field of modern trading. He founded the world’s first school to teach trading on the market.

Bill is better known as the developer of several popular indicators. The most popular ones are the “Alligator” and “Fractals.” Let’s find out an effective strategy of combining Fractals and the RSI.

What are Bill William and RSI indicators anyway?

The Williams Indicator and RSI are a tool you use in technical analysis of trade markets. They are handy in determining the direction of the trend. Let’s briefly explain them.

Bill Williams’ fractals have little to do with fractal mathematical theory. In this scenario, fractals draw arrows to indicate highs and lows of the financial market. Usually, the red color illustrates a bullish trend. Conversely, the blue color represents a bearish trend.

Fractals can also draw a U-shaped pattern on the chart. This U-shaped pattern indicates highs and lows. These highs and lows occur according to the candlesticks. In an uptrend, the price moves down and then goes up, forming a U. Contrarily, in a downtrend, the price moves from up and comes down to form a U.

Now, let’s move to the RSI. RSI is an acronym for the Relative Strength Index. It is one of the most popular indicators of the oscillator class. It consists of one line. The calculations of this line happen by a complex formula. The formula averages the chart’s price values for a certain past period.

The RSI line shows oversold and overbought conditions from 0-100. When the indicator illustrates above 70 reading, it’s overbought condition. It suggests buyers are winning, and the trend will come down. Conversely, when the RSI marks below 30 readings, it’s oversold condition. It mentions sellers are driving, and the trend can go up. Fifty is the neutral level.

It marks neither bulls nor bears. In this strategy, the Relative Strength Index acts as a filter. This is because fractals frequently surface on the chart. You have to combine it with another indicator to filter the market noise.

Such market noise or whipsaw makes detecting entry and exit points harder so we have to use an oscillator to help limit these whipsaws. Hence, the RSI oscillator helps in filtering any false signals.

- Free Online Interactive Binary Options Charts and Why You Should Use Them

- 11 BEST PAPER TRADING APPS (TRADE WITH NO RISK)

- What is Forex? Unknown Facts & Figures (The Ultimate Guide)

- Investors take Forex platform ROFX and its founders to court

- IronFX Review 2024: Is it right for you?

- Do Futures Trade on Weekends? Learn Which Markets Have Weekend Trading

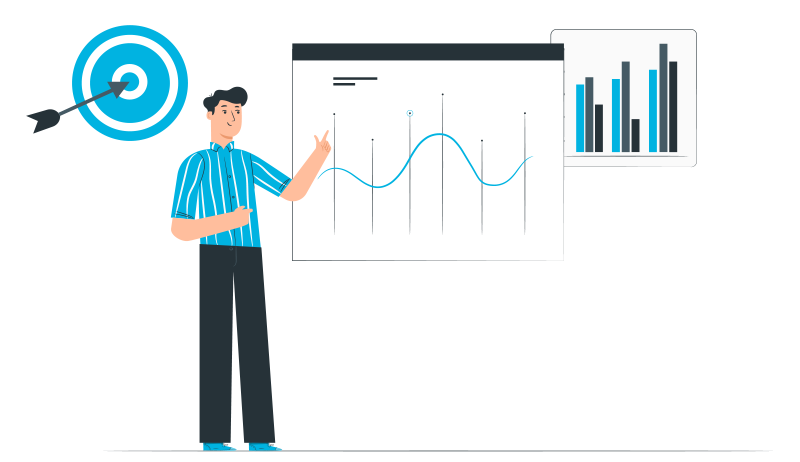

How can you configure your trading platform?

To apply the strategy, you have first to set up your trading platform. There’s no rocket science behind it, but we’ll walk you through how you can configure your platform.

Often, I see traders neglect setting up their trading platform properly.

Setting up a trading platform is part and parcel of any trading strategy. You might be well aware of the Tradingview platform. Charts show us plenty of info, so what we need to do is make this data concise. We can only compress the data if we set up our trading platform accordingly. When setting up your trading platform, you should ask:

- What timeframe should I use?

- Which indicators are best for me?

- Which chart should I apply?

I am answering these questions before the trade helps you get the relevant info. One of the good things about this strategy is applying it to any asset. For instance, you can use it for any forex pair or stocks. However, there’s an exception. You can’t use the strategy on cryptocurrencies with a USD pair. For example, BTC/USD and LTC/USD. This is because they have a low-profit percentage.

How to set up the platform?

Here’s how you can set the platform:

- Asset — any currency pair or shares and raw materials

- Time frame — from 15 seconds to 5 minutes, ideally 1 minute

- Expiration — depends on the time frame, it should equal 2–5 candles

- Investment — according to risk-management rules, 1–5 % of the account or less

- Indicators — the Alligator with a display function for fractals and RSI.

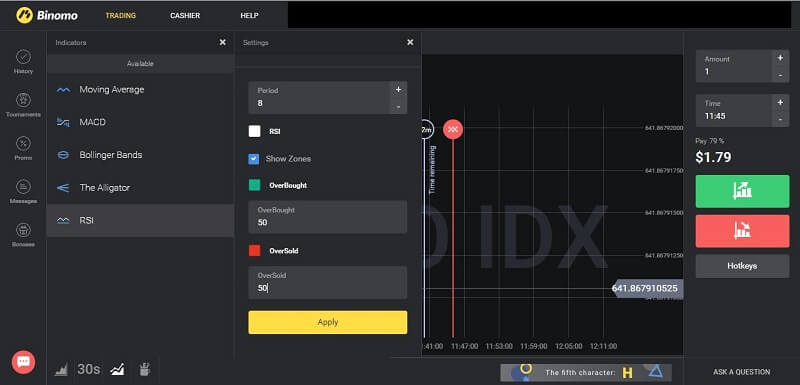

You need to specifically configure the RSI. The period of the RSI should equal eight. The indicator’s overbought/oversold zones should match 50-mark. Now here’s an excellent idea to make things more interesting. You can make the overbought area green and you can paint the oversold region red. You can see an example of an RSI indicator in the picture below.

RSI indicator on the chart

- The Most Popular Trading Assets For Binary Options

- How to use a scalping strategy for options trading?

- Features of Islamic account for trading forex and binary options

- Review of Best Binary Option Brokers in 2024

- CXMARKETS BROKER REVIEW 2024: PROS AND CONS

- Intrade.Bar Unleashed: Squeezing Potential in Binary Options Trading

Signal for options "up."

Now that you have set up the platform, it’s time to enter the trade. There are two conditions for opening an extended position. Let’s find out which are those.

First, the chart should show a descending fractal. This fractal has a structure like a downward triangle. You can find it under a Japanese candle. Second, the oscillator must cross level 50 and enter the overbought zone.

Signal up option chart

The extremum consists of 5 candles. There is a delay of two price elements in real-time before it appears on the chart. In most cases, a fractal appears first, followed by confirmation from the RSI. You can enter the market right after the closure of the signal candle. The signal candle suggests there was an intersection of the RSI zone borders.

- How to set take-profit and stop-loss on the IQ option platform?

- Review of Best Binary Option Brokers in 2024

- Is Quotex a scam? Read this before trying the broker in 2024

- Convert Satoshi To BTC Bitcoin | 100% Free Online Tool

- How to make money on binary options with 0 deposit?

- 110 Trading Quotes to Set You on the Road to Success

Signal for options "down."

For entering short, you can reverse the buying strategy. The signals are similar. Here’s how you can apply them.

First, you need to look for an upward fractal and a transition of the RSI to the oversold area. For clarity, here’s the picture illustrating the option down signal: You can see that we enter after three candles of the extremum. This is just a model because the confirmation from the filter didn’t appear immediately.

Signal down options chart

An example of trading on a fractal reversal

Now that you know the signals for up and down options, let’s move to a standard. This example will help you in practicing the strategy. The actual effectiveness of the model strategies comes when you practice them. We’ve done that to save you some hassle.

For this example, we opened a trade on the Binomo platform. We chose the crypto index with a 30-second timeframe. We selected this timeframe because signals form better on it.

Time Frame selection

We instantly got a signal to buy an “Up” option. It was the intersection. The RSI and the downward extremum produced the signal. Therefore, we opened a trade on the increase. The expiration time was two minutes, which on our timeframe equals four candles.

We didn’t get a strong trend, however, we can see a bit of deviation to profit from the trading options contracts. So, we got an $8 net profit on a $10 investment. There was a signal on the market to purchase an option “down” also. It happened when the RSI returned to the oversold zone. Above the candle, there was an upward fractal.

Is the strategy worth it?

Now, I know many of you are thinking, is the fractal RSI filter strategy worth it? Well, let’s find out.

The fractal reversal RSI filter has pros and cons like any other strategy. Let’s talk about the pros first!

- The strategy is a great predictor of a trend reversal.

- The combo of fractals and RSI is an excellent blend for finding a trend reversal.

- Fractals appear first and the RSI confirms the signal.

- When you see the reversal, you can enter after the confirmation.

Now, let’s talk about the issues you may face in this strategy.

- Sometimes you can’t have the perfect trend.

- You get the confirmation signal, but the trend doesn’t go your way.

- Fractals do pop up frequently on the chart.

- Even when we use the RSI; sometimes there are a few deviations.

Although this strategy is accurate, you also must look for these points.

Login with Google

Login with Google