Mastering Your Mindset for Strategic Trading

Trading psychology, or the mental game, plays a pivotal role in trading success. Imagine a trade setup occurs, but the trader is feeling anxious and doesn’t take advantage of it. An opportunity for profit is lost. Another trader is feeling aggressive or overeager. They jump into a poor-quality setup because they want action. They overtrade and erase the profits made on good trades.

The following chart shows an example of a range breakout and opportunity enter on the pullback that follows. Psychology plays a critical role in how much profit is extracted from this trade, even by traders attempting to use the same strategy.

A composed trader is likely to capture a large chunk of the ensuing move if using a trailing stop loss. A nervous trader may exit on a small red candle that doesn’t actually trigger the trailing stop loss.

Let’s explore how psychology sabotages traders in various ways and tools to overcome these pitfalls to maximize profits and increase the probabilities of trading success.

The Psychology Behind Using Crypto Trade Tools

The way people trade, the tools they use, the markets and time frames they trade on, and how they manage themselves while trading are all influenced by psychology.

For example, one trader may believe it is risky to hold positions overnight, and so they only day trade. They enjoy reacting quickly to market changes and use a one- or five-minute chart.

Another trader may believe that money can only be made in large swings, so they hold positions for months. They utilize hourly, daily, or weekly charts and longer-term technical indicators, potentially looking at the economic fundamentals as well.

No matter the tools traders use, psychology plays a role in how they are implemented.

Take the following chart, for example. The price of Bitcoin is rising, yet the RSI indicator is now in overbought territory. Someone who uses the RSI and is eager to lock in profit may take the overbought reading as a signal to exit, even though the price is still rising. Their own fear of giving back profit is telling them to exit — not the market or even the RSI.

Another trader, who also utilizes the RSI but is more patient in waiting for the price to confirm the indicator, continues to hold for a larger profit than the other trader. This latter trader understands that fear of loss is not a reason to exit. They stick with the trade while it is working, according to their strategy.

- Market Types in Financial Market (Bull, Bear, Range)

- Reliable Binary Options Brokers for Nigerian Traders in 2024

- 5 Best Binary Options Brokers in New Zealand in 2024

- Top 4 Binary Options Brokers in South Africa

- The Forex Order Types: Limit, Stop, and Market

- Mastering Candlestick Patterns: Tips for Profitable Trading

Psychological Techniques to Improve Your Trading Decisions

Trading stirs up emotions. It is inevitable. And you don’t have to lack emotion altogether to be good at trading. Rather, successful traders have found ways to manage or direct their emotions in such a way as to help, or at least not harm, their trading.

Emotional detachment exercises, setting clear goals, having risk limits, journaling, and mindfulness techniques can aid in managing emotions like a pro. Here’s how.

Emotional Detachment

Emotional detachment is not about being emotionless but about being able to choose not to act on the emotion. Here’s a way to view trading to remain more emotionally detached during trading hours.

Trading strategies are created and updated outside trading hours when there is time to ponder, research, and review trades/charts and other data. This is like management coming up with how a business should run.

During trading hours, the trader’s job is simply to follow the protocol set out by management. Their job is not to question or overthink, or even worry about how much profit is made. That’s management’s concern.

During trading hours, just follow the plan. The more this idea is embraced, the less emotional effect the ups and downs of the day will have.

This is important in all trading situations, but especially when prices are moving swiftly and emotions tend to be high.

The following chart shows the Bitcoin flash crash of May 2021. The price fell from near $59,000 to below $52,000 and then recovered back to $56,000, all within the two-hour candle.

Psychology plays a pivotal role in how a trader fares in such circumstances.

The trend is down, so consider two short-term traders who are short when the big drop happens. One trader rides the down move until there is a reason to exit (the price starts rising, and their indicators turn bullish). They capture a huge profit from this rare event. They do this by simply following protocol, as discussed above.

A trader who is nervous about giving back profits as the price drops only captures a tiny piece of the move. They want to take their profit, so they will take any excuse to do it. Their psychology prevents them from capitalizing. They are not following their protocols. Instead, they are interfering in their system mid-trade — the opposite of what was discussed above.

As prices turn higher, with a calm mind, the trader sees an opportunity to profit from the recovery.

Someone who is scared to trade misses the opportunity. Or worse yet, if they are afraid to go long after the drop—even though the price is rising—and they continue to short while the price recovers to $56,000, they lose even more money.

A long trader following their strategy and not overthinking it exits per their rules and avoids a major loss as the price continues to plummet.

Another long trader doesn’t want to accept the loss, so they hold. As the price continues to plummet, they end up panic selling, taking a much larger loss than a trader that had a stop loss and stuck with it.

Notice how the difference in these scenarios is psychological. The market did the same thing for every trader. It was whether they could stick with their system and remain detached that made all the difference.

To remain emotionally detached while trading, think of yourself as the employee just following a strategy—easy and simple. This is opposed to trying to come up with new ways to trade while in a trade—mentally draining, stressful, and hard.

Setting Clear Goals and Limits

Setting goals can also help manage emotions, but not in the way most people do it. Most traders set goals like “I’ll make $1,000 today or $10,000 this month.” Break it down. What needs to happen in order for you to reach that goal?

Research and test whether the strategy being used can produce that dollar return. If it can’t, the strategy needs work. If it can, then the goal is to just follow the strategy as described in the emotional detachment section above.

Focusing on the money tends to increase emotion and produce more trading mistakes. Don’t focus on the money; focus on all the tiny things that need to happen to make the money (the strategy parameters being followed). Set risk limits for each trade and choose how profits will be taken as per strategy guidelines. The goal is to do that on every trade.

The decline in Tesla (TSLA) stock in 2022 exemplifies this. A trader that is long and sticks to a pre-planned stop loss avoids the major decline that ensues. They are concerned about following process, not hoping they make money.

Another trader fails to set a stop loss, ignoring that the price is now making lower lows (no longer an uptrend). They continue to hold a mounting loss. Not only do they lose a lot more money than the prior trader, but they also forgo the opportunity to use that time and money to profit from other opportunities (other long or short trades).

Mindfulness Techniques

The more overwhelmed we get, the more it will negatively affect our trading.

Schedule regular breaks during the trading day to keep the mind clear and healthy.

Remember to take deep breaths throughout the trading session. When an emotion starts to rise, take a deep breath and let the shoulders fall on the exhale. At the same time, offer a self-reminder to follow the trading strategy. The more we do it, the more of a habit it will become.

Meditation outside trading hours can help lower emotional intensity and also allow for longer periods of intense focus, which trading often requires.

Such practices can help with staying focused on following the strategy because of less mental fatigue. It can also help avoid revenge trading, which is a symptom of not sticking to a strategy and a deteriorating mental state.

The chart above shows a typical trending day in Ethereum. A trader who sits back, breathes deeply, and isn’t in a rush to trade (waits for opportunities) is presented with multiple opportunities to take short trades and capitalize as the price drops.

While entry strategies vary, such days present opportunities if a trader simply follows the strategy and maintains a mind frame to do that. Three relatively easy short trades are highlighted on the chart.

Contrast this with someone who is not mindful of their mental state. They let their emotions get the best of them. They are overeager to trade. They take multiple losses as the price consolidates, hoping for a drop. They end up missing the drops as a result. This makes them scared to lose, so when the price does drop, they only capture a small piece, taking profits quickly. This then frustrates them, so they end up overtrading again—revenge trading—once again taking multiple losses when the price doesn’t move much. They hope for a drop, but the price isn’t dropping yet. The cycle continues.

Our first mindful patience trader captures profit on the day. They feel mentally fresh. An easy day. The second trader has lost money. They wasted money when the price was chopping around and then were too scared to take another loss when the price actually started dropping, so they took quick profits that didn’t offset their losses.

Bring the focus back to the breath to remain calm and focused. Take breaks when needed to maintain a good mind frame to follow a set strategy.

Apply the 1-2% Risk Rule in Real Trades

Set clear risk limits on how much can be lost on a trade. This way, the worst outcome is already known and can be accepted before you even place a trade.

Accepting the possibility of loss, even though it isn’t the desired outcome, reduces strong emotions when losses inevitably occur.

Consider only risking 1% to 2% of account capital on a single trade. This can also help manage emotions since even if the trade is lost, most of the account balance is still safe.

The following EURUSD chart shows how this works. A trader going short during a downtrend in the EURUSD with a $10,000 account can risk up to $100 on the trade (1% of $10,000). In this example, with a downtrend underway, the price pulled back and then began to drop again (dropping below a prior candle low in the pullback). The risk was 59 pips. In a USD account, the pip value is $1 per mini lot, so the trader could take a position of 1.7 mini lots (17 micro lots), resulting in a risk of $100.30.

If the price continues to rise, they lose $100.30 (1.7 x $59). If the price drops, they could capture a 3:1 reward:risk relatively easily based on the momentum of the existing downtrend.

Assume a trader doesn’t follow the protocol and instead takes a random position size of two standard lots. That’s 20 mini lots, resulting in a risk of 59 pips x $1/per pip x 20 mini lots, or $1,180 dollars. In this case, if the price rose, the trader would lose more than 10% of their account in a single trade. Several losing trades in a row like this, and the trader could be almost entirely wiped out. In this case, it did drop, but losing trades are inevitable, so managing risk is a must.

The 1% risk rule assures that no single trade can damage the account. This also allows for clearer thinking because the stakes are lower if a trade doesn’t move lower (in this case) as expected. Taking position sizes that are too large tends to create more panic, which leads to more mistakes and eventually wiping out the account.

Trading Journals

A trader’s greatest tool is their trading journal. In a journal, traders record their thoughts about trades, what they saw or felt at the time, and what they did poorly and well, ideally with screenshots showing the context of the trades.

Over time, traders can spot common mistakes and then brainstorm on how to reduce those mistakes. They may notice ways to improve strategies by analyzing trades and limiting beliefs. Journaling may be able to reduce emotional outbursts by noting what situations tend to cause the problems and figuring out how to handle them better.

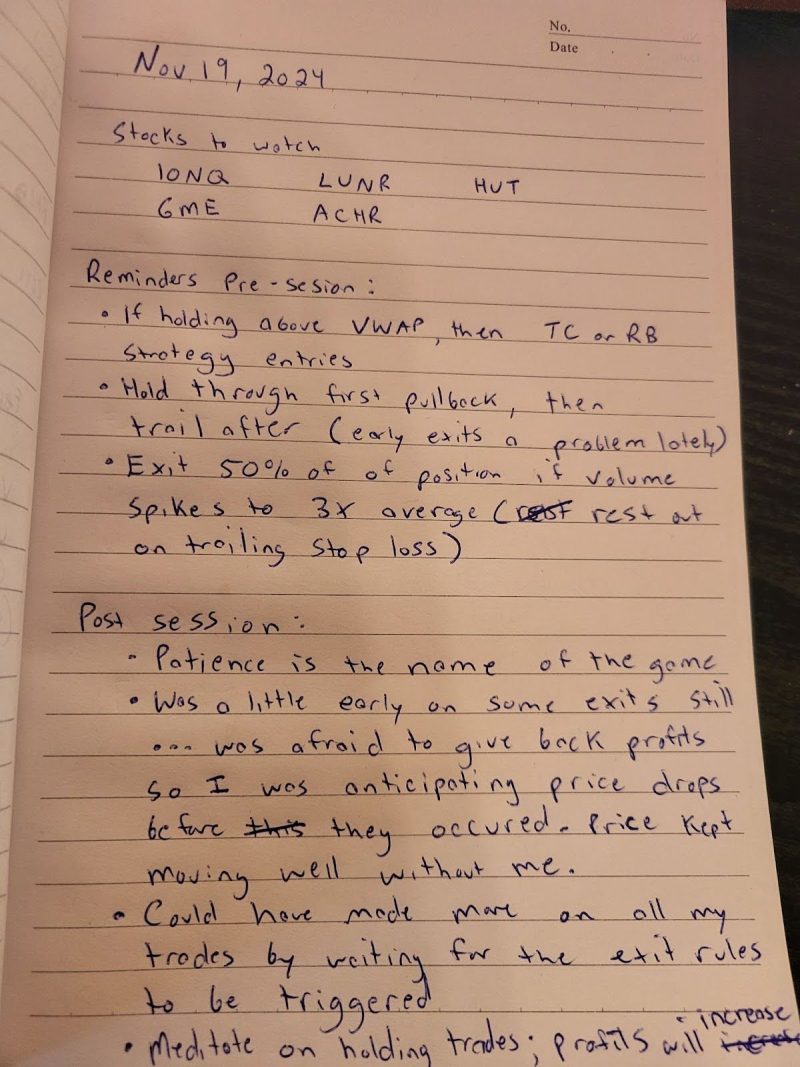

Here is an entry from my own day-trading journal in 2024. Note that this is not a trade log where I just list trades. A trading journal tracks mistakes, what is being done well, and ideas for improvement. At only one page, this is a relatively brief entry. Reflections for the day, or a trade review, can often be multiple pages, especially if there are multiple issues to address.

At the time, I was struggling with exiting trades too early. This was leaving too much profit on the table, and I was also not following my exit rules. I was anticipating good times to exit, instead of waiting for my rules to trigger me out.

Each day before the opening, I would remind myself to follow my rules. Outside trading hours, I talked myself through how if I hold my trades till my exits, my overall profits are better. Exiting early tends to hurt my profits. After several days of this and constant reminders, I was sticking to my exit rules.

Issues are always popping up, even for experienced traders. The trading journal makes sure traders are noticing their issues and working to rectify them continually.

Overcoming Psychological Traps

Psychological traps are human biases or thinking errors. Successful traders know what pitfalls they tend to fall into most often and do self-check-ins to avoid that.

In The Art of Thinking Clearly, Rolf Dobelli lays out 99 common psychological traps.

One is Confirmation Bias, which is when someone seeks information only to confirm an existing belief. This can be problematic since it creates trading blind spots. Potential problem areas are ignored. To remedy this, seek out other points of view. Include what adds value and leave the rest. This creates more robust strategies.

Illusion of Control is another one. Traders have control over their strategies and processes but not over individual trade results. Let go of expecting to win every trade. Instead, focus on following the plan. If the plan is sound, over many trades, profits will be received.

Fear of Missing Out (FOMO) is another very common one. Traders want something to happen or expect something to happen, so they enter a trade (or don’t exit when they should) because they are afraid of missing out on a move that may develop. Instead, they should wait for price action to confirm or deny expectations.

The following chart in Bitcoin shows how such biases can affect traders. If one trader has one of these biases, they may not be able to accept that the upside breakout failed to move up and the price is now dropping. They may continue to hold onto a long in the hopes of a bounce, but instead, they face a mounting loss as price declines.

A trader without these biases easily spots the weak price action (moving back into the old range) and exits, avoiding the decline that follows.

Tips for Improving Your Trading Mindset

Regularly put in time and effort to improve the mental game. Without it, following even a great strategy will be difficult. Practice emotional detachment, set goals focusing on the steps you need to reach them, and set aside time for mindfulness each day. Try to cap risk on each trade to 2% or less of the account balance and keep a trading journal to improve on common mistakes.

This is required, continually, to trade well over the long-term. Such practices allow traders to adapt to changing market conditions, capitalize on opportunities, and effectively manage risk.

One trader I worked with had an issue with FOMO. They were always attempting to capture moves that might develop, but rarely did. We worked on having them follow a process—waiting for moves to start before entering. We stuck to following a process as opposed to thinking about results.

I routinely use my trading journal to spot areas of struggle in my own trading. Another example is when I wasn’t taking enough risks. I was getting nervous about losing after a good streak, so I was continually lowering my position size, missing out on profits. Through my trade journal and reviewing trades, I could see that my strategies were still working well and deserved to be traded with my regular position size.

Another trader I worked with always felt out of sync with the market: taking losses when the market wasn’t moving and never in when it was. We worked on emotional detachment, accepting emotions, and following the plan in spite of them. While losses can’t be avoided, this helped them be in trades when the market was moving, ultimately collecting profits that more than offset the losses.

Mastering mindset is not a destination. It is a daily process. Utilize the tools above to regularly maximize the probability of success.

Login with Google

Login with Google